Pakistani Rupee to Saudi Riyal on October 16, 2022 Pakistani Rupee to Euro on October 15, 2022 The Euro /PKR parity depends on open market rates, they are set by the market forces based on foreign currency demand. KARACHI: Following are the rates of buying and selling of one Euro (EUR) in Pakistani Rupee (PKR) in the open market on October 16, 2022: Pakistani Rupee to Euro on October 16, 2022 Pakistani Rupee to UK Pound Sterling on October 15, 2022 The UK Pound Sterling /PKR parity depends on open market rates, they are set by the market forces based on foreign currency demand. Selling: Rs 252.50 to the UK Pound Sterling KARACHI: Following are the rates of buying and selling of one UK Pound Sterling (GBP) in Pakistani Rupee (PKR) in the open market on October 16, 2022:īuying: Rs 250.00 to the UK Pound Sterling Pakistani Rupee to UK Pound Sterling on October 16, 2022 Pakistani Rupee to UAE Dirham on October 15, 2022

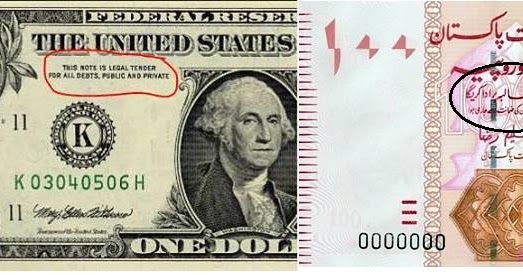

The UAE Dirham /PKR parity depends on open market rates, they are set by the market forces based on foreign currency demand. KARACHI: Following are the rates of buying and selling of one UAE Dirham (AED) in Pakistani Rupee (PKR) in the open market on October 16, 2022: Pakistani Rupee to UAE Dirham on October 16, 2022 Pakistani Rupee to Canadian Dollar on October 15, 2022 The Canadian Dollar /PKR parity depends on open market rates, they are set by the market forces based on foreign currency demand. The selling rate means an exchange company or a bank sells for foreign currency from a customer. Selling: Rs 162.00 to the Canadian Dollar KARACHI: Following are the rates of buying and selling of one Canadian Dollar (CAD) in Pakistani Rupee (PKR) in the open market on October 16, 2022: Pakistani Rupee to Canadian Dollar on October 16, 2022 Pakistani Rupee to US Dollar on October 15, 2022 The US Dollar /PKR parity depends on open market rates, they are set by the market forces based on foreign currency demand. The rate has been updated at 09:00 AM Pakistan Standard Time (PST). The selling rate means an exchange company or a bank sells the foreign currency from a customer. The buying rate means an exchange company or a bank buys foreign currency from a customer. Moreover, the country's foreign exchange reserves have also declined in recent weeks, which is another source of concern for investors.KARACHI: Following are the rates of buying and selling of one US dollar (USD) in Pakistani Rupee (PKR) in the open market on October 16, 2022: "Some of the ruling coalition partners are due to visit Saudi Arabia next week and it is a key event to watch," Sohail added.įinance Minister Ishaq Dar will be leading a high-powered delegation to the US which will attend the upcoming annual spring meeting of the Bretton Woods Institutions, known as the IMF and World Bank, from April 10 to 16. "Uncertainty on IMF and friendly countries' inflow affecting rupee," said Mohammad Sohail, CEO of Topline Securities. The lender approved a USD 3 billion loan programme for Sri Lanka last month to ease its economic crisis. The IMF's resident representative for Pakistan said the country has a few more tasks to complete to meet requirements for a USD 6.5 billion bailout. It was topped up with another USD 1 billion last year to help the country following devastating floods, but the IMF then suspended disbursements in November due to Pakistan's failure to make more progress on fiscal consolidation.Īfter months-long unfruitful talks, the Washington-based lender has asked Pakistan to seek commitments for new loans from Saudi Arabia and the United Arab Emirates before it revives the bailout. The cash-strapped nation secured a USD 6 billion IMF bailout in 2019. The nation has missed multiple deadlines to resume its bailout. Pakistan's loan programme is yet to materialise months after it raised taxes and energy prices and allowed the currency to depreciate to meet IMF's conditions. According to financial experts, Financial importers have resumed the panic buying of US dollars, while the supply of foreign currency remained low in the interbank market.

0 kommentar(er)

0 kommentar(er)